Trial and Error in Strategy Development

I initially started with the classic Moving Average (MA) strategy. To be honest, I don’t remember the exact steps I followed, but after that, I tried oscillator-based indicators and every strategy I could think of.

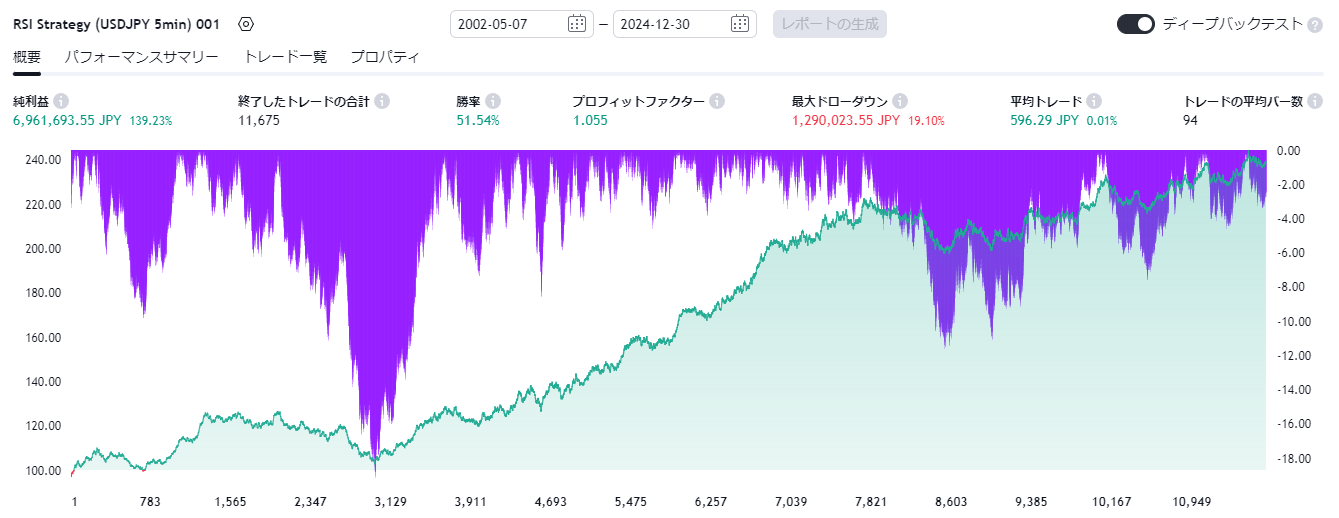

Instead of manually checking historical charts, I utilized TradingView’s backtesting feature to streamline the process.

Conditions Prioritized in the Initial Stage

At first, I searched for strategies that seemed practical based on the following criteria:

-

Frequent Trading Opportunities: At least once per day

-

Risk-Reward Ratio of 1:1: Balanced profit and stop-loss targets

-

Win Rate Above 50%: Ensuring a statistical edge

-

Controlled Impact of Spreads: Stop-loss of 30 pips and take-profit of 30 pips

A Stable Combination

After testing various strategies, I found that a combination of ultra-short-term RSI and MA performed relatively consistently, so I adopted it as my base strategy.

When applying the strategy via Pine Script on the USDJPY 5-minute chart, the win rate was 51.54%. However, when switching to longer timeframes, such as the 15-minute chart or higher, the win rate started to decline. On the 1-hour chart, the win rate dropped to 47.52%, showing a downward trend.

This suggests that counter-trend strategies might be more effective on the 1-hour timeframe.

//@version=6

strategy("RSI Strategy (USDJPY 5min) Draft", overlay=true, default_qty_type=strategy.percent_of_equity, pyramiding=1, initial_capital=5000000, currency="JPY", default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.0, margin_long=1/100, margin_short=1/100)

// 期間を2に変更、RSI overSold、overBoughtを5と95に

length = input(2)

overSold = input(5)

overBought = input(95)

longLength = input.int(200, "Long MA Length")

price = close

vrsi = ta.rsi(price, length)

longma = ta.sma(close, longLength)

// overSoldかoverBought

co = ta.crossover(vrsi, overSold) and strategy.position_size == 0 and close > longma

cu = ta.crossunder(vrsi, overBought) and strategy.position_size == 0 and close < longma

// maをチャートに表示

plot(longma, title="Long MA", color=color.new(color.gray, 0), linewidth=2, style=plot.style_line)

// 損切と利確の設定

stop_loss_pips = input.float(29, "Stop Loss (in pips)")

take_profit_pips = input.float(31, "Take Profit (in pips)")

// 利確損切Pips計算

pips_multiplier = syminfo.mintick * 10

adjusted_stop_loss = stop_loss_pips * pips_multiplier

adjusted_take_profit = take_profit_pips * pips_multiplier

if (not na(vrsi))

if (co)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

strategy.exit("RsiLE Exit", stop=strategy.position_avg_price - adjusted_stop_loss, limit=strategy.position_avg_price + adjusted_take_profit)

if (cu)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

strategy.exit("RsiSE Exit", stop=strategy.position_avg_price + adjusted_stop_loss, limit=strategy.position_avg_price - adjusted_take_profit)

Understanding the Strategy and Future Challenges

Based on the results so far, I’m considering the following next steps:

- Why does the win rate decrease on higher timeframes?

- What specific market conditions is this strategy targeting?

By thoroughly understanding these points, I aim to refine the strategy through better filtering criteria and further improvements.